PNB SIP Calculator

Yearly Breakdown

| Year | Investment | Total Invested | Future Value |

|---|

PNB SIP Calculator 2025 | Calculate Mutual Fund Returns Online

Table of Contents

PNB SIP Calculator: Calculate Your Systematic Investment Plan Returns

Planning your financial future has never been easier with the PNB SIP calculator. Whether you’re investing in Punjab National Bank’s mutual fund schemes or exploring systematic investment plans, our advanced SIP calculator helps you estimate returns, plan investments, and build long-term wealth through disciplined investing.

What is PNB SIP Calculator?

The PNB SIP calculator is a sophisticated financial planning tool designed specifically for investors looking to calculate potential returns from systematic investment plans in PNB Asset Management mutual fund schemes. This investment calculator leverages compound interest principles to project future wealth accumulation based on your regular monthly SIP contributions.

Key Features of PNB SIP Calculator:

- Real-time calculations for PNB mutual fund SIP returns

- Goal-based planning for retirement, education, and wealth creation

- Step-up SIP functionality to accommodate salary increments

- Tax benefit calculations for ELSS mutual fund investments

- Comparative analysis across different PNB mutual fund schemes

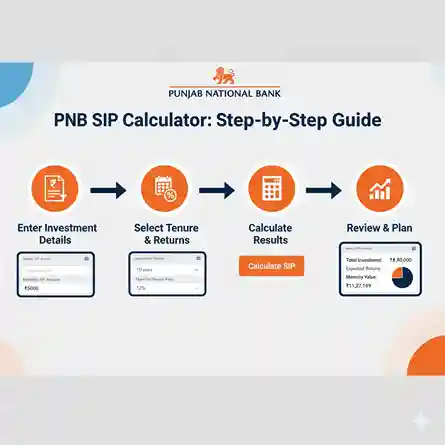

How to Use PNB SIP Calculator – Complete Guide

Using our PNB mutual fund SIP calculator is straightforward and user-friendly. Follow this comprehensive step-by-step process to calculate your systematic investment plan returns accurately.

Step 1: Enter Your Investment Details

- Monthly SIP Amount: Input your desired monthly investment (minimum ₹500)

- Investment Tenure: Select your investment period (6 months to 30 years)

- Expected Annual Return: Choose realistic return expectations (8% – 15%)

- Step-up Percentage: Optional annual increment in SIP amount

Step 2: Review Calculated Results

The PNB SIP return calculator instantly displays:

- Total investment amount over the tenure

- Expected maturity value at the end of investment period

- Wealth gained through systematic investment

- Month-wise investment growth projection

- Power of compounding visualization

Step 3: Compare Different Scenarios

Adjust variables to compare various investment scenarios:

- Different monthly SIP amounts

- Varying investment tenures

- Multiple expected return rates

- Impact of step-up SIP investments

PNB Mutual Fund SIP Schemes Available

Punjab National Bank Asset Management offers diverse mutual fund schemes suitable for systematic investment plans, catering to different risk appetites and investment objectives.

[Image 3: PNB Mutual Fund Schemes Overview] Alt Text: “Comprehensive overview of PNB Asset Management mutual fund schemes including equity, debt and hybrid funds available for SIP investment” Title: “PNB Mutual Fund Schemes for Systematic Investment Plans”

Equity Mutual Fund SIP Options

Large Cap Funds:

- PNB Large Cap Fund – Stable returns with lower volatility

- Investment in top 100 companies by market capitalization

- Ideal for conservative equity investors

Mid Cap and Small Cap Funds:

- PNB Mid Cap Fund – Higher growth potential

- PNB Small Cap Fund – Maximum growth opportunities

- Suitable for aggressive investors with long-term horizon

Flexi Cap Funds:

- PNB Flexi Cap Fund – Diversified across market capitalizations

- Dynamic allocation based on market conditions

- Balanced approach to equity investing

Debt Mutual Fund SIP Options

Short-term Debt Funds:

- PNB Ultra Short Duration Fund – Minimal interest rate risk

- PNB Short Term Fund – Moderate duration exposure

- Perfect for conservative investors seeking stable returns

Medium-term Debt Funds:

- PNB Medium Term Fund – Optimal duration strategy

- Suitable for 3-5 year investment horizon

- Better returns than traditional fixed deposits

Hybrid Mutual Fund SIP Options

Balanced Advantage Funds:

- PNB Conservative Hybrid Fund – 65% debt, 35% equity allocation

- PNB Aggressive Hybrid Fund – 65% equity, 35% debt allocation

- Automatic rebalancing based on market conditions

Benefits of PNB SIP Investment

Investing through systematic investment plans with Punjab National Bank’s mutual fund schemes offers numerous advantages for wealth creation and financial goal achievement.

[Image 4: Benefits of PNB SIP Investment] Alt Text: “Infographic showing key benefits of PNB SIP investment including rupee cost averaging, compounding returns, tax benefits and flexible investment options” Title: “Top Benefits of PNB Systematic Investment Plan”

Rupee Cost Averaging Advantage

- Market Volatility Protection: Regular investments reduce the impact of market fluctuations

- Average Purchase Cost: Buy more units when prices are low, fewer when prices are high

- Long-term Wealth Creation: Systematic approach eliminates emotional investing decisions

Power of Compounding Returns

- Exponential Growth: Earnings generate additional earnings over time

- Time Value of Money: Earlier investments have more time to compound

- Wealth Multiplication: Small regular investments grow into substantial corpus

Flexible Investment Options

- Low Minimum Investment: Start SIP with just ₹500 per month

- Tenure Flexibility: Choose investment period from 6 months to 30 years

- Step-up Facility: Increase SIP amount annually with salary increments

Tax Benefits and Savings

- Section 80C Deduction: ELSS SIP offers tax deduction up to ₹1.5 lakh annually

- Long-term Capital Gains: Favorable tax treatment for investments held over 1 year

- Tax-efficient Wealth Creation: Better post-tax returns compared to traditional investments

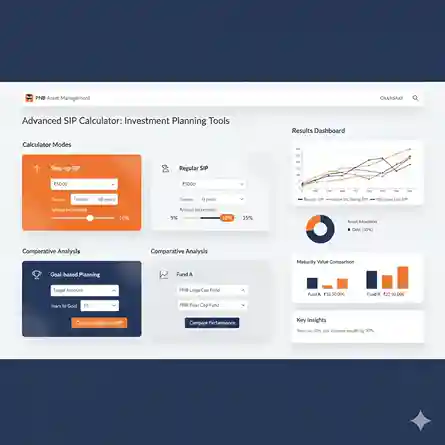

PNB SIP Calculator Features and Functionality

Our advanced PNB mutual fund SIP calculator incorporates sophisticated features to provide accurate investment projections and comprehensive financial planning assistance.

Standard SIP Return Calculator

- Basic Return Calculation: Simple future value estimation

- Investment Growth Tracking: Year-wise investment progression

- Maturity Value Projection: End-of-tenure corpus calculation

- Wealth Gain Analysis: Total returns over investment period

Advanced Step-up SIP Calculator

- Annual Increment Planning: Accommodate salary growth in SIP planning

- Inflation-adjusted Returns: Real return calculation considering inflation

- Progressive Wealth Building: Accelerated corpus accumulation strategy

- Dynamic Investment Planning: Adapt to changing financial circumstances

Goal-based SIP Planning Tool

- Target Amount Calculation: Determine required SIP for specific goals

- Timeline-based Planning: Investment duration for desired corpus

- Multiple Goal Tracking: Separate calculations for different objectives

- Priority-based Allocation: Optimal fund distribution across goals

Factors Affecting PNB SIP Returns

Understanding the variables that influence your systematic investment plan returns helps in making informed investment decisions and setting realistic expectations.

Market Performance Factors

- Fund Management Expertise: Professional fund managers’ skill in stock selection

- Asset Allocation Strategy: Optimal distribution across different securities

- Market Cycle Impact: Bull and bear market phases on overall returns

- Economic Conditions: GDP growth, inflation, and policy changes

Investment Horizon Considerations

- Short-term Volatility: Market fluctuations in initial investment years

- Long-term Compounding: Extended investment periods maximize wealth creation

- Market Cycle Benefits: Longer tenures capture complete market cycles

- Risk-Return Trade-off: Time horizon impacts risk tolerance and return expectations

SIP Amount and Frequency Impact

- Regular vs Irregular Contributions: Consistency in investment discipline

- Monthly vs Quarterly SIP: Frequency impact on rupee cost averaging

- Step-up SIP Advantages: Annual increment benefits for wealth acceleration

- Lump Sum vs SIP: Systematic approach vs one-time investment comparison

How to Start PNB SIP Online – Complete Process

Beginning your systematic investment journey with Punjab National Bank’s mutual fund schemes involves a streamlined digital process designed for investor convenience.

[Image 6: PNB SIP Online Investment Process] Alt Text: “Step-by-step visual guide showing online PNB SIP investment process from KYC completion to SIP registration and portfolio tracking” Title: “Complete Guide to Starting PNB SIP Investment Online”

Online SIP Investment Process

Step 1: Complete KYC Requirements

- Submit PAN Card and Aadhaar verification

- Provide address proof and photograph

- Bank account verification through cancelled cheque

- Digital KYC completion through video verification

Step 2: Select Suitable Mutual Fund Scheme

- Assess risk tolerance and investment objectives

- Choose appropriate PNB mutual fund scheme

- Review fund performance and expense ratio

- Understand investment strategy and portfolio composition

Step 3: SIP Registration and Setup

- Determine monthly SIP amount and date

- Set up automatic bank debit mandate

- Choose investment tenure and step-up options

- Review and confirm SIP registration details

Step 4: Investment Monitoring and Tracking

- Regular portfolio performance review

- Monthly SIP debit confirmation

- Annual portfolio rebalancing if required

- Goal-based investment progress tracking

Required Documents for PNB SIP

- Identity Proof: PAN Card (mandatory)

- Address Verification: Aadhaar Card or Utility Bills

- Bank Details: Cancelled cheque or bank statement

- Photograph: Passport-size photograph for physical applications

- Income Proof: Salary slip or ITR for high-value investments

PNB SIP Calculator vs Other Investment Calculators

Understanding the unique advantages of using a dedicated PNB SIP calculator compared to other bank-specific and generic mutual fund calculators helps investors make informed decisions.

PNB SIP Calculator Advantages

- Scheme-specific Calculations: Accurate projections based on actual PNB fund performance

- Historical Return Integration: Real fund performance data for realistic expectations

- Goal-based Planning Tools: Customized calculation for specific financial objectives

- Tax Benefit Integration: Automatic ELSS tax saving calculation

Compare with Other Bank SIP Calculators

Popular Bank-Specific SIP Calculators:

- SBI SIP Calculator – Calculate returns for State Bank of India mutual fund schemes

- HDFC SIP Calculator – Plan investments in HDFC Asset Management funds

- ICICI SIP Calculator – Estimate returns for ICICI Prudential mutual funds

- Axis SIP Calculator – Calculate Axis Mutual Fund SIP returns

Universal SIP Calculator Options

For comprehensive comparison across all mutual fund houses, use our Universal SIP Calculator that allows you to:

- Compare returns across different fund houses

- Analyze multiple schemes simultaneously

- Access Step up SIP Calculator for advanced planning

- Get unbiased investment projections

Generic SIP Calculator Limitations

- Generic Return Assumptions: May not reflect actual fund performance

- Limited Customization: Basic calculation without scheme-specific features

- No Goal Integration: Separate calculation required for different objectives

- Manual Tax Calculations: Additional effort for tax benefit computation

Common SIP Investment Mistakes to Avoid

Learning from common systematic investment plan mistakes helps investors optimize their wealth creation journey and achieve better financial outcomes.

Timing the Market Mistake

- Market Timing Attempts: Trying to predict market highs and lows

- Investment Discipline: Importance of consistent monthly investments

- Dollar-cost Averaging Benefits: Regular investing reduces timing risk

- Long-term Perspective: Focus on investment goals rather than market movements

Inadequate Investment Planning

- Unclear Financial Goals: Lack of specific investment objectives

- Insufficient Risk Assessment: Mismatch between risk capacity and fund selection

- Irregular Portfolio Review: Neglecting periodic investment evaluation

- Emotional Investment Decisions: Panic selling during market downturns

SIP Amount Miscalculation

- Unrealistic SIP Amounts: Overestimating monthly investment capacity

- Ignoring Inflation Impact: Not accounting for cost escalation in goal planning

- Single Goal Focus: Not diversifying SIP across multiple financial objectives

- Step-up Negligence: Missing opportunities for annual SIP increment

Tax Implications of PNB SIP Investments

Understanding the tax treatment of systematic investment plan investments helps in optimizing post-tax returns and efficient tax planning.

ELSS SIP Tax Benefits

- Section 80C Deduction: Tax saving up to ₹1.5 lakh annual investment

- Lock-in Period: Mandatory 3-year investment tenure for tax benefits

- Long-term Capital Gains: Favorable tax treatment after lock-in expiry

- Dividend Tax Treatment: Tax implications of dividend distributions

Non-ELSS SIP Taxation

- Equity Fund Taxation: Short-term (15%) vs long-term (10%) capital gains tax

- Debt Fund Taxation: Indexation benefits for long-term investments

- Dividend Distribution Tax: Impact on regular income from mutual funds

- Tax Loss Harvesting: Strategic selling for tax optimization

Frequently Asked Questions About PNB SIP Calculator

Q1: What is the minimum SIP amount for PNB mutual funds?

Answer: The minimum SIP amount for most PNB mutual fund schemes is ₹500 per month. However, certain schemes may have higher minimum requirements. ELSS funds typically require a minimum of ₹500 monthly SIP for tax benefits under Section 80C.

Q2: How accurate are the returns shown by PNB SIP calculator?

Answer: The PNB SIP calculator provides estimates based on historical performance and assumed future returns. Actual returns may vary based on market conditions, fund performance, and economic factors. The calculator uses realistic return assumptions to provide practical projections.

Q3: Can I modify my SIP amount after starting the investment?

Answer: Yes, you can increase, decrease, or temporarily pause your SIP amount based on your changing financial situation. Most modifications can be done online through your investment account or by contacting customer service.

Q4: What happens if I miss a SIP installment?

Answer: Missing occasional SIP installments doesn’t terminate your plan. However, frequent missed payments may lead to SIP cancellation. It’s advisable to maintain sufficient balance and inform the fund house about temporary financial constraints.

Q5: Are PNB SIP investments covered under any insurance?

Answer: Mutual fund investments, including PNB SIP, are market-linked and not guaranteed or insured. However, investor protection measures exist through regulatory oversight by SEBI and investor education initiatives.

Q6: How long should I continue my PNB SIP?

Answer: The optimal SIP duration depends on your financial goals, age, and risk tolerance. Generally, equity SIPs should continue for at least 5-7 years to benefit from compounding and market cycle advantages. Goal-based SIPs should align with target achievement timelines.

Investment Tips for Maximizing PNB SIP Returns

Start Early Advantage

- Time Value of Money: Earlier investments have more compounding time

- Lower Monthly Burden: Smaller SIP amounts for longer duration achieve goals

- Market Cycle Benefits: Extended investment periods capture multiple cycles

- Habit Formation: Early start develops disciplined investment behavior

Diversification Strategy

- Multiple Fund Categories: Spread investments across equity, debt, and hybrid funds

- Market Cap Diversification: Combine large cap, mid cap, and small cap exposures

- Sector Allocation: Avoid concentration in single industry or theme

- Risk Balancing: Mix aggressive and conservative fund selections

Regular Review and Rebalancing

- Annual Portfolio Assessment: Review investment performance and goal progress

- Asset Allocation Adjustment: Rebalance based on changing risk profile

- Underperforming Fund Evaluation: Consider switching consistently poor performers

- Goal Timeline Modification: Adjust strategy based on changing life circumstances

Conclusion: Start Your PNB SIP Journey Today

The PNB SIP calculator serves as your comprehensive tool for systematic investment planning and wealth creation through Punjab National Bank’s mutual fund schemes. Whether you’re planning for retirement, children’s education, or building an emergency fund, disciplined SIP investing with proper calculation and planning leads to financial success.

Use our advanced SIP calculator to:

- Calculate realistic investment returns

- Plan goal-based systematic investments

- Compare different investment scenarios

- Optimize your monthly investment amount

- Track wealth creation progress

Ready to start your wealth creation journey? Use the PNB SIP calculator today and take the first step toward achieving your financial goals through systematic investment planning.

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Past performance is not indicative of future results. Consult your financial advisor for personalized investment advice.