SIP Calculator

Yearly Breakdown

| Year | Investment | Total Invested | Future Value |

|---|

SIP Calculator – Calculate Your Mutual Fund Returns Online | Free Investment Tool 2025

Plan your systematic investment journey with our advanced SIP calculator. Calculate mutual fund returns, compare investment strategies, and achieve your financial goals with precise calculations starting from just ₹500 per month.

Start your wealth creation journey with our intuitive SIP calculator designed for accurate mutual fund return calculations and comprehensive investment planning.

What is a SIP Calculator and How It Works

A SIP calculator is an advanced online financial tool that helps investors calculate the potential returns from their Systematic Investment Plan investments in mutual funds. This powerful investment calculator uses compound interest mathematics to demonstrate how regular monthly investments can grow exponentially over time through the magic of compounding.

Our mutual fund SIP calculator considers critical factors including monthly investment amount, investment tenure, expected annual returns, and market volatility to provide accurate projections of your investment’s maturity value. Whether you’re planning for retirement, child education funding, home purchase, or long-term wealth creation, this SIP return calculator serves as an indispensable tool for making informed investment decisions.

The calculator employs the standard SIP formula: M = P × [{(1 + i)^n – 1} / i] × (1 + i), where systematic investing meets mathematical precision to project your financial future with remarkable accuracy.

How to Use Our Advanced Online SIP Calculator

Complete Step-by-Step Process:

Step 1: Enter Your Monthly SIP Amount Input the amount you wish to invest monthly through your systematic investment plan. You can start with as little as ₹500 per month and scale up based on your financial capacity and goals. Our calculator accommodates investments from ₹500 to ₹1,00,000 per month.

Step 2: Select Your Investment Period Choose your investment horizon ranging from 1 year to 30 years. Remember, longer investment periods typically yield better returns due to the compounding effect. For equity mutual funds, we recommend a minimum 5-year investment horizon for optimal results.

Step 3: Set Expected Annual Returns Enter your expected annual return rate based on historical fund performance. Equity mutual funds historically average 12-15% returns, debt funds offer 7-9%, while hybrid funds provide 9-12% returns over extended periods.

Step 4: Calculate and Analyze Results Click “Calculate SIP Returns” to view your comprehensive investment projection including maturity amount, total investment, wealth gained, and effective annual returns.

Understanding Your Detailed Results:

- Maturity Amount: Total corpus value at investment completion

- Total Investment: Sum of all monthly SIP installments

- Wealth Gained: Additional money earned through compound growth

- Effective Returns: Your actual percentage gains over the investment period

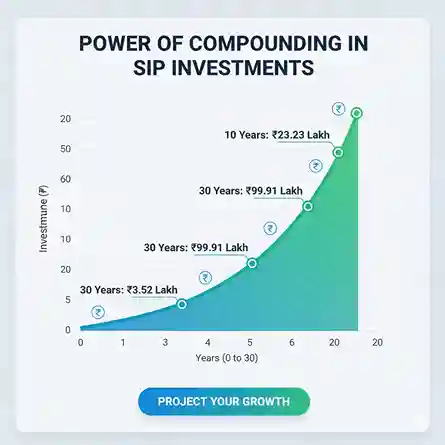

The Power of Compounding in SIP Investments

Witness the extraordinary power of compounding through systematic investing. The compound interest effect transforms modest monthly investments into substantial wealth over extended periods. Consider this remarkable example: a monthly SIP of ₹10,000 at 12% annual returns grows to ₹23.23 lakhs in 10 years, ₹99.91 lakhs in 20 years, and an impressive ₹3.52 crores in 30 years.

This exponential growth occurs because your returns generate additional returns, creating a snowball effect that accelerates wealth creation. The longer your investment horizon, the more pronounced this compounding effect becomes, making early investing crucial for long-term financial success.

Rupee cost averaging further enhances your returns by purchasing more mutual fund units when prices are low and fewer units when prices are high, effectively reducing your average purchase cost over time.

SIP vs Lumpsum Investment: Comprehensive Comparison

Understanding the fundamental differences between SIP vs lumpsum investing helps you choose the optimal strategy for your financial situation and market conditions.

When to Choose Systematic Investment Plan (SIP):

Advantages of SIP Investment:

- Regular Income Alignment: Perfect for salaried individuals with consistent monthly cash flows

- Market Volatility Protection: Rupee cost averaging minimizes timing risks and market volatility impact

- Disciplined Investment Approach: Builds systematic investing habits and financial discipline

- Lower Initial Capital Requirement: Start wealth creation with amounts as low as ₹500

- Flexibility: Modify, pause, or discontinue investments based on changing financial circumstances

When to Consider Lumpsum Investment:

Lumpsum Investment Benefits:

- Large Capital Deployment: Suitable when you have significant idle funds requiring investment

- Market Timing Opportunities: Capitalize on market corrections and attractive valuations

- Immediate Market Exposure: Full investment amount starts generating returns immediately

- Lower Transaction Costs: Fewer transactions compared to monthly SIP installments

The comparison reveals that both strategies have distinct advantages, and many successful investors employ a combination approach based on their financial situation and market conditions.

Types of Mutual Funds for SIP Investment

Selecting the appropriate mutual fund category for your SIP investment significantly impacts your long-term returns and risk exposure. Our comprehensive analysis covers all major fund categories suitable for systematic investing.

Equity Mutual Funds for High Growth:

Large Cap Equity Funds:

- Investment Focus: Top 100 companies by market capitalization

- Expected Returns: 10-12% annually over long term

- Risk Level: Moderate to high

- Investment Horizon: Minimum 5-7 years

- Volatility: Lower compared to mid and small cap funds

Mid Cap Equity Funds:

- Investment Focus: Companies ranked 101-250 by market cap

- Expected Returns: 12-15% annually over long term

- Risk Level: High

- Investment Horizon: 7-10 years recommended

- Growth Potential: Higher than large cap funds

Small Cap Equity Funds:

- Investment Focus: Companies beyond top 250 by market cap

- Expected Returns: 15-18% annually over very long term

- Risk Level: Very high

- Investment Horizon: 10+ years essential

- Volatility: Highest among equity categories

ELSS Funds – Tax Saving with Growth:

Equity Linked Saving Scheme (ELSS) funds offer dual benefits of tax savings under Section 80C and wealth creation potential. These funds have a mandatory 3-year lock-in period and invest primarily in equity markets.

- Tax Deduction: Up to ₹1.5 lakhs annually under Section 80C

- Expected Returns: 12-15% over long term

- Lock-in Period: 3 years (shortest among tax-saving instruments)

- Additional Benefits: Continued investment flexibility after lock-in expires

Debt Mutual Funds for Stability:

Debt Fund Categories:

- Expected Returns: 7-9% annually

- Risk Level: Low to moderate

- Investment Horizon: 2-5 years optimal

- Stability: Lower volatility compared to equity funds

Hybrid Mutual Funds for Balance:

Balanced Fund Approach:

- Asset Allocation: Mix of equity and debt securities

- Expected Returns: 9-12% annually

- Risk Level: Moderate

- Suitable For: Conservative investors seeking balanced growth

Goal-Based SIP Investment Planning

Strategic financial planning through goal-based SIP investing ensures you achieve specific life objectives with mathematical precision and disciplined execution.

Child Education Planning:

Target Corpus: ₹25 Lakhs (Current Cost: ₹10 Lakhs)

- Investment Period: 15 years

- Inflation Assumption: 8% annually for education costs

- Required Monthly SIP: ₹8,500 at 12% expected returns

- Fund Recommendation: Equity-heavy portfolio for long-term growth

Retirement Planning Strategy:

Target Corpus: ₹2 Crores for comfortable retirement

- Investment Period: 25-30 years

- Current Age: 30-35 years

- Required Monthly SIP: ₹15,000 at 12% expected returns

- Asset Allocation: Gradually shift from equity to debt as retirement approaches

Home Purchase Down Payment:

Target Corpus: ₹20 Lakhs (down payment)

- Investment Period: 10 years

- Property Price: ₹80 Lakhs (current market rate)

- Required Monthly SIP: ₹12,000 at 12% expected returns

- Strategy: Combination of equity and debt funds

Emergency Fund Creation:

Target Corpus: ₹10 Lakhs (6-12 months expenses)

- Investment Period: 5 years

- Fund Type: Liquid and ultra-short duration funds

- Required Monthly SIP: ₹14,000 at 8% expected returns

- Accessibility: High liquidity with minimal exit load

ELSS SIP Tax Benefits and Optimization

Maximize your tax savings while building long-term wealth through ELSS SIP investments that offer dual advantages of Section 80C deductions and equity market exposure.

Tax Calculation Example:

Annual ELSS Investment: ₹1,50,000 through monthly SIP of ₹12,500

- Tax Bracket: 30% (income above ₹10 lakhs)

- Tax Saved: ₹46,500 annually

- Effective Investment: ₹1,03,500 (after tax savings)

- Lock-in Period: Only 3 years (shortest among tax-saving options)

Comparative Analysis with Other Tax-Saving Instruments:

ELSS vs PPF Comparison:

- ELSS: Market-linked returns (12-15%), 3-year lock-in, equity exposure

- PPF: Fixed returns (7-8%), 15-year lock-in, debt-like stability

- NSC: Fixed returns (6-7%), 5-year lock-in, lower growth potential

Strategic Tax Planning: Combine ELSS investments with other tax-saving instruments for comprehensive tax optimization while building a diversified investment portfolio aligned with your risk tolerance and financial goals.

SIP Calculator Formula and Mathematical Foundation

Understanding the mathematical foundation behind SIP calculations empowers you to make informed investment decisions and validate calculator results independently.

Standard SIP Formula Explained:

M = P × [{(1 + i)^n – 1} / i] × (1 + i)

Where:

- M = Maturity Amount (final corpus value)

- P = Monthly Investment Amount

- i = Expected Monthly Return Rate (Annual Rate ÷ 12)

- n = Total Number of Monthly Investments (Years × 12)

Detailed Calculation Example:

Investment Parameters:

- Monthly SIP Amount (P): ₹10,000

- Annual Expected Return: 12%

- Investment Period: 10 years

Mathematical Breakdown:

- Monthly Return Rate (i): 12% ÷ 12 = 1% (0.01)

- Total Months (n): 10 × 12 = 120

- Formula Application: M = 10,000 × [{(1.01)^120 – 1} / 0.01] × 1.01

Final Results:

- Maturity Amount: ₹23,23,391

- Total Investment: ₹12,00,000 (₹10,000 × 120 months)

- Wealth Gained: ₹11,23,391

- Effective Annual Return: 12% compounded monthly

This mathematical precision demonstrates how systematic investing transforms regular contributions into substantial wealth through the power of compounding.

Mobile-Optimized SIP Calculator Features

Access comprehensive SIP calculations anywhere, anytime with our mobile-optimized online SIP calculator designed for seamless smartphone and tablet usage.

Mobile-Specific Features:

Touch-Friendly Interface:

- Large, easily tappable input fields optimized for mobile screens

- Intuitive slider controls for quick parameter adjustments

- Responsive design adapting to various screen sizes and orientations

- Fast loading times optimized for mobile network conditions

Advanced Mobile Capabilities:

- Offline Functionality: Calculate returns without internet connectivity

- Quick Share Options: Share calculation results via WhatsApp, email, or social media

- Screenshot Capability: Save calculation results as images for future reference

- Voice Input: Speak your investment parameters for hands-free calculation

Mobile User Experience Benefits:

- One-Handed Operation: Interface optimized for single-thumb navigation

- Instant Results: Real-time calculations as you adjust parameters

- Multiple Scenarios: Save and compare different investment scenarios

- Cross-Device Sync: Access saved calculations across devices

Complete Results Analysis and Dashboard

[IMAGE 10: Results Dashboard – Output Visualization] Placement: In results explanation section

Our comprehensive results dashboard provides detailed insights beyond basic calculation outputs, enabling informed investment decision-making through visual data representation.

Detailed Results Breakdown:

Investment Summary Panel:

- Total Investment: Sum of all monthly SIP contributions

- Estimated Returns: Additional money earned through market growth

- Maturity Value: Final corpus available at investment completion

- Effective Annual Return: Your actual percentage gains considering compounding

Visual Analytics:

- Growth Chart: Year-wise investment value progression

- Pie Chart: Investment vs returns proportion visualization

- Comparison Table: Performance against different return scenarios

- Milestone Tracking: Progress indicators for goal achievement

Advanced Analytics Features:

- Sensitivity Analysis: Impact of varying return rates on final corpus

- Inflation Adjustment: Real purchasing power of future money

- Tax Implications: Post-tax returns based on current tax rates

- Goal Achievement Probability: Statistical likelihood of reaching targets

Actionable Insights:

- Optimization Suggestions: Recommended adjustments for better results

- Alternative Scenarios: Comparison with different investment strategies

- Risk Assessment: Volatility impact on expected outcomes

- Timeline Adjustments: Effect of extending or reducing investment period

Advanced SIP Strategies and Optimization

Step-Up SIP Strategy:

Annual SIP Enhancement: Increase your monthly SIP amount by 10-15% annually to counter inflation and boost wealth creation. A ₹10,000 monthly SIP with 10% annual step-up reaches ₹67.12 lakhs versus ₹46.95 lakhs with fixed SIP over 15 years.

Flexible SIP Approach:

Variable Investment Amounts: Adapt your monthly investment based on income fluctuations, bonus receipts, and financial circumstances while maintaining systematic investing discipline.

Top-Up SIP Strategy:

Bonus Investment Integration: Supplement regular SIP with annual lump sum investments from bonuses, tax refunds, or windfall gains to accelerate wealth creation.

Common SIP Investment Mistakes to Avoid

Unrealistic Return Expectations:

Don’t base calculations on exceptional market performance years. Use conservative estimates (10-12% for equity funds) for realistic planning and avoid disappointment during market corrections.

Inadequate Investment Horizon:

Short-Term SIP Pitfalls:

- Market volatility impact increases with shorter periods

- Insufficient time for rupee cost averaging benefits

- Higher probability of capital loss in unfavorable markets

Ignoring Inflation Impact:

Real Return Consideration: Factor inflation (typically 6-7%) when calculating future purchasing power. A 12% nominal return equals 5-6% real return after inflation adjustment.

Neglecting Asset Allocation:

Diversification Importance: Spread investments across different fund categories, market capitalizations, and sectors to reduce concentration risk and enhance portfolio stability.

Related Investment Calculators and Tools

Essential Financial Planning Calculators:

Lumpsum Calculator – Calculate returns on one-time investments and compare with SIP strategy

SWP Calculator – Plan systematic withdrawals from accumulated mutual fund corpus during retirement

ELSS Calculator – Optimize tax-saving investments with detailed ELSS return projections

Retirement Calculator – Plan comprehensive retirement corpus considering inflation and lifestyle expenses

EMI Calculator – Calculate loan EMIs for integrated financial planning and investment decisions

PPF Calculator – Compare Public Provident Fund returns with mutual fund SIP investments

Educational Investment Resources:

Complete SIP Investment Guide – Comprehensive beginner’s manual for systematic investing

Best Mutual Funds for SIP 2025 – Curated list of top-performing funds for SIP investment

Asset Allocation Strategies – Portfolio diversification techniques for optimal risk-return balance

Mutual Fund Selection Criteria – Expert framework for choosing suitable funds based on goals

Frequently Asked Questions (FAQs)

Q1. How accurate is the SIP calculator?

Answer: Our SIP calculator provides mathematical projections based on compound interest principles and historical market data. While calculations are precise, actual returns may vary due to market volatility, fund management changes, and economic factors. Use calculator results as estimates for planning purposes.

Q2. What’s the minimum amount required to start SIP?

Answer: Most mutual funds accept SIP starting from ₹500 per month, though some funds may have higher minimum requirements. We recommend starting with an amount you can comfortably invest consistently without financial strain.

Q3. Can I modify my SIP amount during the investment period?

Answer: Yes, most fund houses allow SIP modifications including amount increases, decreases, pausing, or stopping. However, maintain investment discipline and avoid frequent changes that might impact long-term wealth creation goals.

Q4. How are SIP returns taxed in India?

Answer: Tax treatment depends on fund type and holding period:

- Equity Funds: Long-term capital gains (>1 year) taxed at 10% above ₹1 lakh annual gains; Short-term gains (<1 year) taxed at 15%

- Debt Funds: Gains taxed according to your income tax slab rates

- ELSS Funds: Similar to equity funds with additional Section 80C tax deduction benefits

Q5. What return rate should I assume for SIP calculations?

Answer: Use conservative estimates based on historical performance:

- Equity Funds: 10-12% for long-term planning

- Debt Funds: 7-9% for stable returns

- Hybrid Funds: 8-10% for balanced approach Avoid using exceptionally high rates that might lead to unrealistic expectations.

Q6. Is SIP better than fixed deposits or PPF?

Answer: SIP offers potentially higher returns through market exposure but with increased volatility. Fixed deposits provide guaranteed returns (currently 5-7%) while PPF offers 7-8% with tax benefits. Choose based on risk tolerance, investment horizon, and financial goals.

Start Your SIP Investment Journey Today

Ready to transform your financial future through systematic investing? Our SIP calculator has provided you with the mathematical foundation and strategic insights needed to make informed investment decisions.

Immediate Action Steps:

- Calculate Your Requirements: Use our calculator to determine monthly SIP amounts for your goals

- Choose Appropriate Funds: Select mutual fund categories aligned with your risk tolerance

- Start Small, Think Big: Begin with ₹500-1000 and increase gradually as income grows

- Maintain Discipline: Stick to your SIP schedule regardless of market conditions

- Review Periodically: Assess and adjust your strategy based on goal progress and life changes

Professional Guidance:

Consider consulting with certified financial planners for personalized investment strategies, especially for complex financial goals or substantial investment amounts.

Remember: The best time to start investing was yesterday, and the second-best time is today. Begin your systematic investment journey and harness the power of compounding for long-term wealth creation.

Disclaimer: The calculations provided by this SIP calculator are for illustrative purposes only and based on assumed rates of return. Actual mutual fund returns are subject to market risks and may vary significantly. Past performance does not guarantee future results. Please read all scheme-related documents carefully before investing and consult with financial advisors for personalized investment advice.

Keywords: SIP Calculator, Mutual Fund SIP Calculator, SIP Investment Calculator, Online SIP Calculator, SIP Return Calculator, Systematic Investment Plan Calculator, Investment Planning, Goal-based Investment, ELSS Calculator, Retirement Planning, Compound Interest Calculator, SIP vs Lumpsum, Step-up SIP, Financial Planning Calculator